75% of finance teams spend 6 hours per week recreating financial reports, amounting to 300 hours per year.

Modernize Finance, Cut Risks, and Unlock AI

Logistics finance leaders: book a free session to identify your finance bottlenecks, uncover ROI opportunities, and get tailored AI and automation recommendations.

Finance Under Pressure in Global Logistics

Finance teams in logistics service providers (LSPs) are under more pressure than ever. As FreightTech accelerates operations and customer expectations rise, finance can no longer afford to be reactive.

In global logistics— an industry facing increasingly volatile costs and complex multi-entity compliance— finance teams are increasingly expected to contribute to high-level strategy, guiding decisions that shape resilience and growth.

In short, CFOs have the potential to shift from mere risk managers into true allies for innovation. But, often, their systems are holding them back.

Finance in Transit: From Back Office to Control Tower

Finance is the fiscal lifeblood of logistics firms, providing a critical link in the decision chain. The rise of big data is underscoring this role, yet many global LSPs are still burdened by:

In a sector where margins are thin and complexity is high, this gap represents a real competitive threat.

Modern Finance changes that. With the right tools, teams can leverage data insights, automation, and advanced analytics to make proactive, informed decisions.

Considering the scale, speed, and complexity that multinational logistic service providers (LSPs) require, this is no small task.

That’s why HSO has partnered with Microsoft and Aptitude Software to enable finance departments to fulfill their role as enablers of strategic business goals.

With our combined expertise, we are empowering the next generation of finance leaders with tools that automate data-centric tasks and leverage AI to open new business opportunities.

75% of finance teams spend 6 hours per week recreating financial reports, amounting to 300 hours per year.

60%

59%

57%

44% of the 1,700 Finance and IT executives surveyed named data quality and reliability as a top obstacle.

The 2024 Autonomous Finance Benchmark Research stated that as a top obstacle jeopardizing strategic decisions. According to the same research, the top three areas where businesses will see ROI in the coming 3-5 years are:

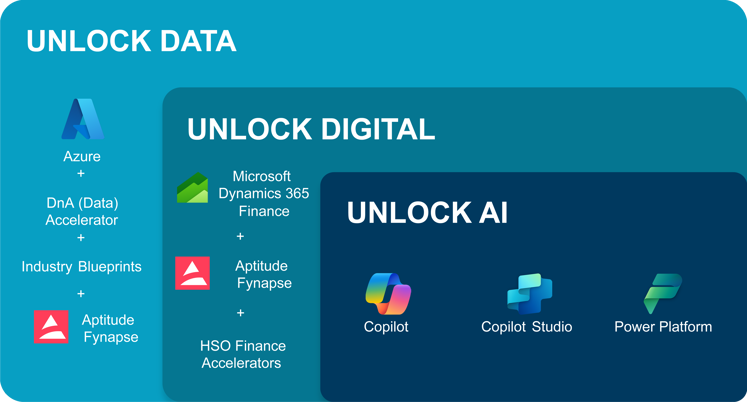

Our Three Keys to Unlocking Autonomous Finance

Without a strong foundation, you can’t visualize the path to realize your vision. That’s why we’ve crafted a three-tier layered approach to help finance teams uncover their strategic superpowers and drive real impact.

The basics of finance modernization start with a robust data strategy. Without unified, actionable data, you’ll be stuck in the weeds.

The result? Ready-to-use data consolidation templates, task checklists, and prototypes for unified structures that reduce mistakes and save you time.

Modern Finance is digital by nature. By embracing the cloud and modern ERP systems, you can automate processes and shatter standard financial reporting timelines.

The result? Near real-time reporting that reduces time spent on month-end and year-end closings, freeing up resources for strategic tasks.

Modern Finance is autonomous. Proactive instead of reactive. By analyzing historical data and offering predictive insights, AI tools light up the path to make risk-conscious decisions on the way to your goals.

The result? Personalized Finance AI Copilots and digital agents that streamline operations, helping your team focus on big picture strategy.

Where can your organization most benefit from modern finance?

Get a free finance modernization plan to discover how your finance team can move from reactive reporting to strategic leadership.

Built on Microsoft, Customized by HSO, Powered by Aptitude

This is not our first rodeo. HSO, Microsoft, and Aptitude Software have come together to develop a comprehensive solution for modernizing finance departments. This trinity combines unique, battle-tested finance modernization tools with Microsoft’s cutting-edge cloud and AI technologies to make the most of today’s dynamic market trends.

HSO leverages expertise across industries to adapt Microsoft Dynamics 365 Finance, Power Platform, and Aptitude Fynapse to the unique needs of each client. We augment these with our DnA Data and Finance frameworks to enable insight-revealing, near real-time reporting.

Key benefits of our collaborative solutions include:

Ensures compliance and accuracy across all financial operations.

Harness data visibility with intuitive dashboards and analytics.

Build a platform that fits your business needs like a glove and add features as requirements change.

A flexible cloud infrastructure that grows with your organization.

Streamline settlement and payment processes.

Access Our Whitepaper With 3 Transformation Frameworks and 6 ROI Benchmarks

This whitepaper is a guide where we explore:

Explore our proven roadmap to Modern Finance.

Our Proven Approach: Modern Finance Discovery & Diagnostics

Benchmark your current finance maturity and chart the best path forward.

What you'll get:

Spot inefficiencies and compliance risks before they impact your bottom line.

Skip months of internal analysis—get expert insights in just weeks.

Use our business control model heatmap and ROI snapshot to align stakeholders and justify change.

Get a Free

Finance Modernization Plan

In our 2-hour Modern Finance Envisioning session, together, our industry director will work with you to:

Why join?

Because modern finance isn’t a luxury—it’s a competitive necessity. Let’s uncover how your finance team can move from reactive reporting to strategic leadership.

Success Story: Financial Advisory Firm

A leading US insurance brokerage, partnered with HSO, Microsoft, and Aptitude Software to modernize its finance department. By implementing an integrated solution with Dynamics 365 Finance, Power Platform, and Aptitude Fynapse, they achieved:

This transformation boosted our customer’s agility, accuracy, and transparency, enabling them to respond quickly to market changes and customer demands.

“Executing international finance implementations is not just a job for HSO, it’s who we are.”

Get a Free Finance Modernization Plan

In just 2 hours, you'll walk away with:

-

Trusted by global leaders like Royal Terberg Group and Thomas Concrete Group, HSO delivers a Modern Finance framework that helps logistics firms unify systems, automate operations, and scale with confidence.

Resources

Explore more resources on how HSO enables modern finance transformations for global logistics firms.

How Top Logistics CFOs Are Gaining Strategic Influence with Dynamics 365 Finance and Operations

Meet the new era of automation, agility, and decision-ready data.

Learn how to help your finance team cut manual work, boost reporting speed, and lead with confidence in global logistics with five weeks of expert insights, real-world examples, and proven strategies.

We, and third parties, use cookies on our website. We use cookies to keep statistics, to save your preferences, but also for marketing purposes (for example, tailoring advertisements). By clicking on 'Settings' you can read more about our cookies and adjust your preferences. By clicking 'Accept all', you agree to the use of all cookies as described in our privacy and cookie policy.

Purpose

This cookie is used to store your preferences regarding cookies. The history is stored in your local storage.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

These cookies are stored to keep you logged into the website.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

This cookie is used to submit forms to us in a safe way.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

This service provided by Google is used to load specific tags (or trackers) based on your preferences and location.

Why required?

This web technology enables us to insert tags based on your preferences. It is required but adheres to your settings and will not load any tags if you do not consent to them.

Purpose

This cookie is used to store your preferences regarding language.

Cookies

Why required?

We use your browser language to determine which language to show on our website. When you change the default language, this cookie makes sure your language preference is persistent.

Purpose

This service is used to track anonymized analytics on the HSO.com application. We find it very important that your privacy is protected. Therefore, all data is collected and stored on servers owned by HSO with no third-party dependencies. This cookie helps us collect data from HSO.com so that we can improve the website. Examples of this are: it allows us to track engagement by page, measuring various events like scroll-depth, time on page and clicks.

Cookie

Purpose

This cookie enables HSO to run A/B tests across the HSO.com application. A/B testing (also called split testing) is comparing two versions of a web page to learn how we can improve your experience. All data is collected and stored on servers owned by HSO with no third-party dependencies.

Purpose

With your consent, this website will load Google Analytics to track behavior across the site.

Cookies

Purpose

With your consent, this website will load the Microsoft Clarity script, which helps us understand how people use the site. The cookies set by Clarity collect session-level data like how the visitor landed on the site, which pages they viewed, their language preference, and even their general location. This data powers Clarity’s features like heatmaps and session recordings, helping us see which parts of a page get attention and where users drop off. The goal isn’t to track individuals, but to understand patterns that can improve the user experience. Learn more about Microsoft Clarity cookies here.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Google Advertising tag which enables HSO to report user activity from HSO.com to Google. This enables HSO to track conversions and create remarketing lists based on user activity on HSO.com.

Possible cookies

Please refer to the below page for an updated view of all possible cookies that the Google Ads tag may set.

Cookie information for Google's ad products (safety.google)

Technologies Used

Cookies

Purpose

With your consent, we use IPGeoLocation to retrieve a country code based on your IP address. We use this service to be able to trigger the right web technologies for the right people.

Purpose

With your consent, we use Leadfeeder to identify companies by their IP-addresses. Leadfeeder automatically filters out all users visiting from residential IP addresses and ISPs. All visit data is aggregated on the company level.

Cookies

Purpose

With your consent, this website will load the LinkedIn Insights tag which enables us to see analytical data on website performance, allows us to build audiences, and use retargeting as an advertising technique. Learn more about LinkedIn cookies here.

Cookies

Purpose

With your consent, this website will load the Microsoft Advertising Universal Event Tracking tag which enables HSO to report user activity from HSO.com to Microsoft Advertising. HSO can then create conversion goals to specify which subset of user actions on the website qualify to be counted as conversions. Similarly, HSO can create remarketing lists based on user activity on HSO.com and Microsoft Advertising matches the list definitions with UET logged user activity to put users into those lists.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Microsoft Dynamics 365 Marketing tag which enables HSO to score leads based on your level of interaction with the website. The cookie contains no personal information, but does uniquely identify a specific browser on a specific machine. Learn more about Microsoft Dynamics 365 Marketing cookies here.

Cookies

Technologies Used

Cookies

Purpose

With your consent, we use Spotler to measures more extensive recurring website visits based on IP address and draw up a profile of a visitor.

Cookies

Purpose

With your consent, this website will show videos embedded from Vimeo.

Technologies Used

Cookies

Purpose

With your consent, this website will show videos embedded from Youtube.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Meta-pixel tag which enables us to see analytical data on website performance, allows us to build audiences, and use retargeting as an advertising technique through platforms owned by Meta, like Facebook and Instagram. Learn more about Facebook cookies here. You can adjust how ads work for you on Facebook here.

Cookies

Purpose

With your consent, we use LeadInfo to identify companies by their IP-addresses. LeadInfo automatically filters out all users visiting from residential IP addresses and ISPs. These cookies are not shared with third parties under any circumstances.

Cookies

Purpose

With your consent, we use TechTarget to identify companies by their IP address(es).

Cookies

Purpose

This enables HSO to personalize pages across the HSO.com application. Personalization helps us to tailor the website to your specific needs, aiming to improve your experience on HSO.com. All data is collected and stored on servers owned by HSO with no third-party dependencies.

Purpose

With your consent, we use ZoomInfo to identify companies by their IP addresses. The data collected helps us understand which companies are visiting our website, enabling us to target sales and marketing efforts more effectively.

Cookies