Staying ahead of the competition

Firms that are flexible and comprehensive in their approach to blockers and splitters can:

Fund Accounting

Gain a competitive advantage and increase profitability

Any firm or company with fund entities—private equity firms, asset management firms, hedge funds, and family offices—needs a platform that gives them a competitive advantage and increases profitability. But there are barriers that must be addressed:

Correctly allocating revenues and recoverable costs among funds can be time-consuming and error-prone. Demonstrating compliance, profitability, and accountability can be nearly impossible with siloed data, manual processes, and lack of transparency. All too often, time is spent trying to resolve these issues using only Excel spreadsheets.

To attract more investors, you need to stay ahead of the competition by offering what they cannot, but you need to do it profitably. This requires the flexibility to handle everything from cost-effectively providing self-service options to managing complex fund structures.

Staying ahead of the competition

Firms that are flexible and comprehensive in their approach to blockers and splitters can:

Appeal to a more diverse investor base, e.g, more conservative or mission-related investors

Gain tax efficiencies that benefit you and your investors

Simplify reporting for investors

Have more flexibility in strategic planning

Adapt to changing laws and regulations, mitigating risk

Everything you need in a single, integrated solution

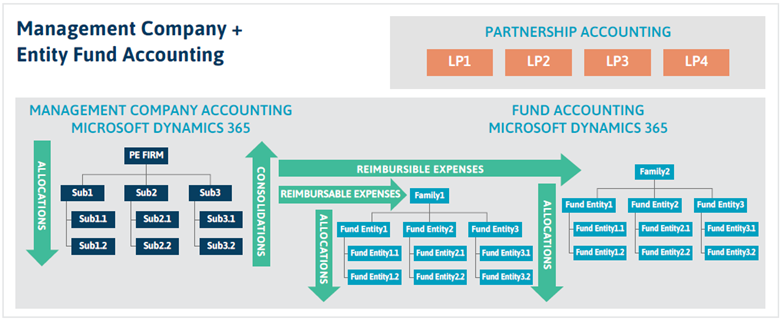

With HSO’s solution for Fund Accounting, you get support of complex fund family structures, enabling the management of the reimbursable expenses of those structures.

The tale of two Private Equity firms

One of the largest global timberland managers, with $3B+ in assets/1.7M acres under management, was struggling with a fund accounting system that was expensive to maintain and required complex consolidations and eliminations across a large number of entities, levels, and currencies, making it difficult to report across the entities.

With HSO’s Fund Accounting, fully integrated with key business applications, the firm’s system was optimized for global, complex entity relationships. The firm now has a fully automated financial consolidation process with visibility across all funds and entities.

A global growth investor with $80B+ AUM and 21 PE funds invested $100B+ in 40 countries has a complex multi-entity structure that was causing challenges at all levels, like difficulty with securely extracting data from multiple sources, which slowed allocations and disbursements…and an aging ERP wasn’t equipped to meet the challenge.

HSO implemented a complete ground-to-cloud transformation with D365 Finance and HSO’s Fund Accounting, which streamlined muti-entity fund accounting processes with near real-time data access

and reporting.

Two solutions in one: Helping asset management firms maintain their books and their investments

HSO’s Fund Accounting helps you:

By automating your processes, you can consolidate hundreds of entities on multiple levels in minutes, regardless of complexity. You get the flexibility to work more efficiently and offer more options to investors, like billing top-level fund families or managing down to each sub-fund company, integrated with your fund accounting tool.

Regardless of how complex your funds are structured, you have what you need with HSO’s Fund Accounting. Beyond a typical ERP:

Visibility and transparency

Whether you’re using HSO’s Fund Accounting for management companies or fund entities, you get visibility and transparency into the end-to-end flow of all your transaction allocations:

Lower transaction costs, better margins

Improved security, compliance, and traceability

The ability to provide better, more proactive client service

Improved data accuracy, visibility, and transparency

Scalability and flexibility for growth and expansion of entities, currencies, taxation, and reporting requirements

Free your data, tear down the silos

If you’re using HSO’s Fund Accounting for both your management companies and fund accounting, you’re at an instant advantage. With one system, your data is always up to date and correct.

With confidence in your data and the ability to access it in near real time, you won’t have to worry about reconciliations between fund accounting, financials, and data warehouses, and you’ll get reports you can depend on.

Discover fsi360: Built for Financial Services Firms

Fund Accounting is part of our fsi360 solution suite. Built on the industry-leading Microsoft Dynamics 365 cloud platform, fsi360 is the financial service industry's most modern and comprehensive marketing, business development, finance and relationship intelligence suite of applications.

Learn more about our experience in Financial Services firms

Contact us to talk to an HSO financial services expert today.

We, and third parties, use cookies on our website. We use cookies to keep statistics, to save your preferences, but also for marketing purposes (for example, tailoring advertisements). By clicking on 'Settings' you can read more about our cookies and adjust your preferences. By clicking 'Accept all', you agree to the use of all cookies as described in our privacy and cookie policy.

Purpose

This cookie is used to store your preferences regarding cookies. The history is stored in your local storage.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

These cookies are stored to keep you logged into the website.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

This cookie is used to submit forms to us in a safe way.

Cookies

Location of Processing

European Union

Technologies Used

Cookies

Expiration date

1 year

Why required?

Required web technologies and cookies make our website technically accessible to and usable for you. This applies to essential base functionalities such as navigation on the website, correct display in your internet browser or requesting your consent. Without these web technologies and cookies our website does not work.

Purpose

This service provided by Google is used to load specific tags (or trackers) based on your preferences and location.

Why required?

This web technology enables us to insert tags based on your preferences. It is required but adheres to your settings and will not load any tags if you do not consent to them.

Purpose

This cookie is used to store your preferences regarding language.

Cookies

Why required?

We use your browser language to determine which language to show on our website. When you change the default language, this cookie makes sure your language preference is persistent.

Purpose

This service is used to track anonymized analytics on the HSO.com application. We find it very important that your privacy is protected. Therefore, all data is collected and stored on servers owned by HSO with no third-party dependencies. This cookie helps us collect data from HSO.com so that we can improve the website. Examples of this are: it allows us to track engagement by page, measuring various events like scroll-depth, time on page and clicks.

Cookie

Purpose

This cookie enables HSO to run A/B tests across the HSO.com application. A/B testing (also called split testing) is comparing two versions of a web page to learn how we can improve your experience. All data is collected and stored on servers owned by HSO with no third-party dependencies.

Purpose

With your consent, this website will load Google Analytics to track behavior across the site.

Cookies

Purpose

With your consent, this website will load the Microsoft Clarity script, which helps us understand how people use the site. The cookies set by Clarity collect session-level data like how the visitor landed on the site, which pages they viewed, their language preference, and even their general location. This data powers Clarity’s features like heatmaps and session recordings, helping us see which parts of a page get attention and where users drop off. The goal isn’t to track individuals, but to understand patterns that can improve the user experience. Learn more about Microsoft Clarity cookies here.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Google Advertising tag which enables HSO to report user activity from HSO.com to Google. This enables HSO to track conversions and create remarketing lists based on user activity on HSO.com.

Possible cookies

Please refer to the below page for an updated view of all possible cookies that the Google Ads tag may set.

Cookie information for Google's ad products (safety.google)

Technologies Used

Cookies

Purpose

With your consent, we use IPGeoLocation to retrieve a country code based on your IP address. We use this service to be able to trigger the right web technologies for the right people.

Purpose

With your consent, we use Leadfeeder to identify companies by their IP-addresses. Leadfeeder automatically filters out all users visiting from residential IP addresses and ISPs. All visit data is aggregated on the company level.

Cookies

Purpose

With your consent, this website will load the LinkedIn Insights tag which enables us to see analytical data on website performance, allows us to build audiences, and use retargeting as an advertising technique. Learn more about LinkedIn cookies here.

Cookies

Purpose

With your consent, this website will load the Microsoft Advertising Universal Event Tracking tag which enables HSO to report user activity from HSO.com to Microsoft Advertising. HSO can then create conversion goals to specify which subset of user actions on the website qualify to be counted as conversions. Similarly, HSO can create remarketing lists based on user activity on HSO.com and Microsoft Advertising matches the list definitions with UET logged user activity to put users into those lists.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Microsoft Dynamics 365 Marketing tag which enables HSO to score leads based on your level of interaction with the website. The cookie contains no personal information, but does uniquely identify a specific browser on a specific machine. Learn more about Microsoft Dynamics 365 Marketing cookies here.

Cookies

Technologies Used

Cookies

Purpose

With your consent, we use Spotler to measures more extensive recurring website visits based on IP address and draw up a profile of a visitor.

Cookies

Purpose

With your consent, this website will show videos embedded from Vimeo.

Technologies Used

Cookies

Purpose

With your consent, this website will show videos embedded from Youtube.

Cookies

Technologies Used

Cookies

Purpose

With your consent, this website will load the Meta-pixel tag which enables us to see analytical data on website performance, allows us to build audiences, and use retargeting as an advertising technique through platforms owned by Meta, like Facebook and Instagram. Learn more about Facebook cookies here. You can adjust how ads work for you on Facebook here.

Cookies

Purpose

With your consent, we use LeadInfo to identify companies by their IP-addresses. LeadInfo automatically filters out all users visiting from residential IP addresses and ISPs. These cookies are not shared with third parties under any circumstances.

Cookies

Purpose

With your consent, we use TechTarget to identify companies by their IP address(es).

Cookies

Purpose

This enables HSO to personalize pages across the HSO.com application. Personalization helps us to tailor the website to your specific needs, aiming to improve your experience on HSO.com. All data is collected and stored on servers owned by HSO with no third-party dependencies.

Purpose

With your consent, we use ZoomInfo to identify companies by their IP addresses. The data collected helps us understand which companies are visiting our website, enabling us to target sales and marketing efforts more effectively.

Cookies