Get more insights from HSO Retail Experts

Using Customer Insights to Improve Processes

What are customer insights?

Customer Insights are deep understandings gained from analysing customer data, behaviours, preferences, and feedback. These insights provide valuable information about customers' motivations, needs, desires, and pain points.

The advent of online retailing has led to a greater focus on Customer Insights and, based on them, loyalty schemes with CRM implementations. CRM programs are cheaper to operate now because the incentives to persuade consumers to provide their data have become a lot less costly.

Online retailing requires shoppers to provide much more information than an in-store shopper. Technology like tokenisation in payment systems has made it easier to link store shopper transactions with online transactions, giving a more comprehensive view of the shopper. Tokenization works in this regard if all channels run the same payment processing software.

1. Lifestyle Profiles

A good place to start is creating lifestyle portraits of 4 to 7 customer types. It can be easily achieved with Microsoft Dynamics 365 Customer Insights. Using a combination of analytics and buyer and store manager knowledge, 4 to 7 customer lifestyles will typically represent 85% or so of the company’s customer base. The remaining 15% will be random shoppers or cherry pickers who do not justify the cost of the effort to treat them in a more specific way.

Analysing customer and basket data will give a first estimate of which lifestyle a customer belongs to. As an example, basket analysis at an individual consumer level will tell you a lot about a customer’s age range, whether they have a family, whether they have pets, whether they are upmarket or middle market, do they do their own home improvements, etc.

Store observations and data capture at the POS device can supplement it. This latter step has to be done unobtrusively by trained store staff at the registers reviewing or entering a lifestyle code for each shopper they serve without making it obvious. This should be an occasional exercise rather than a daily routine.

A good move is to tag each customer in the CRM system with the lifestyle profile that best matches them (including none for the bottom 15%).

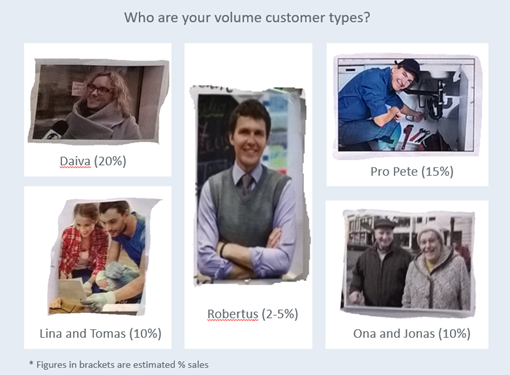

Here’s an example of a home improvement retailer. The photograph reminds us of the lifestyle portrait for each customer type. The percentage in brackets is the estimated share of sales each lifestyle accounts for.

Each photograph is supported by a detailed written lifestyle profile of that customer type. In this case, these profiles account for an estimated 83% to 85% of sales. These profiles are specific to the country and the retailer’s product range.

This analysis will not be perfect, but it will be a lot more helpful than thinking about an average customer and accuracy will get better over time as more data and better analytic tools become available. As AI research progresses, AI tools will be able to finesse this type of analysis and lifestyle attribution more accurately.

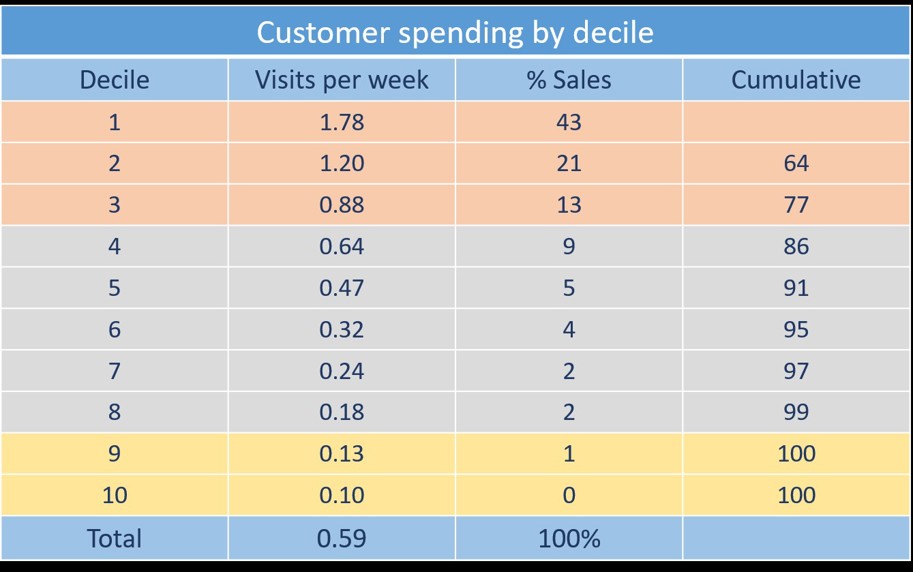

The chart above shows an example decile analysis of your customer base, in this case for a supermarket. In the decile analysis break each of the top 7 deciles out by what percent is in each lifestyle using the individual tags referred to earlier. The paragraphs below discuss several ways to improve business performance using this data.

2. Assortment Planning

How can we improve assortment planning with this insight? Focus your assortment planning process on the top 3 deciles and the lifestyles within those deciles that have the higher percentage shares of sales. Make sure the assortment encompasses all the significant lifestyles represented.

Deciles 4 to 8 in total account for about half the sales of decile 1. Look at any significant lifestyles not represented highly in deciles 1 to 3 and pay more attention to the assortment planning for them. You can total the sales by lifestyle across all 5 of these deciles and take a consolidated view of this.

Identify those consumers that also share the same significant lifestyles with the top 3. These are the ones to nurture to see if you can promote them higher up the table. See additional comments in the promotions section below.

Think about whether the assortments should vary by channel. For example, one retailer found that their online customer was typically 5 years younger than their store customers. In the online channel would these younger customers merit some adjustment to the assortment? In this case, the choices included width of choice (additional lifestyle-relevant choices), good, better, best positioning, fabric choices, and price points. If the age of the online customers means that they are mostly working and the store customers have a higher proportion of retired people, this should be reflected in the lifestyle portraits.

A similar thought process can be applied to locations. Rural lifestyles buy different things to urban lifestyles in some cases. More rural people keep horses and buy hay and feed, for example.

3. Customer Service

Different lifestyles often value different aspects of customer service:

- Some value expert assistance in selecting product choices, and some like to be left alone to make their choices

- Some like self-checkout, where queues may be shorter, and some will always want to be checked out by a person

- Some prefer home delivery, others click and collect

Knowledge of customers' lifestyles and the share of a store’s sales accounted for by each of them will help optimise staffing levels, skill mixes in stores, and the number of self-checkout terminals each store needs, plus a host of other customer service dimensions.

This knowledge should guide even low-level decisions like what background music to play in each store.

Stores that sell everything for the new mother or the new mother to be, are more successful when the sales associates have a good proportion of current mothers among them. For new mothers the cleanliness of bathrooms and the availability of baby changing facilities are important.

Stores that sell home improvement items are another example. In this case, if the customer is a tradesperson like Professional Peter above, they mostly don’t want a store associate telling them how to do a job. A home-owner though like Daiva may be very grateful for the advice. This is why store staff needs to understand the customer lifestyles the store supports, so they can behave accordingly. This is a different and extremely valuable dimension of personalisation.

This type of thought process applies equally online. When a customer logs in to the online store, the pages they see first should be biased to their lifestyle.

Adopting initiatives like these means being able to capture the right data and having the analytics tools and people skills to get the most from them.

4. Using Online Insights

Online, you can track things you can’t track in stores. For example:

- You can track browsing history, identify products they browsed that turned out to be out of stock, and see where the shoppers went next. If you assume that a consumer’s behaviour in this regard will be the same as for an empty shelf position in a store, this will help identify the scope for improvement in demand forecasting.

- When a customer orders, you can track when they removed a product from a basket because it was out of stock and whether they abandoned that aspect of their purchase or whether they bought a substitute and, if so, which one. This insight can be used to adjust demand forecasts when your online retail share is a big enough sample of the company sales.

- You can track on what days customers buy products like barbecue foods. One supermarket chain found that online customers would buy barbecue foods on Monday or Tuesday to get delivery in time for the weekend. The same products would peak in stores on Thursday and Friday, so they could use the online lift to increase store replenishment quantities for those days.

A common missed opportunity today is the ability to sell accessories or complementary items to shoppers coming in to collect an online order. Stores that have mastered this report a 12% to 19% increase on online sales value from doing this. If online orders are 20% of a store’s sales, a 15% uplift would add 3% to store sales and a lot more to store profit. This also reduces online returns as shoppers can be persuaded to try items on where relevant and a different size offered from store stock while the customer is still there.

If the staff handling customer pickups in store have advance notice of what is in the customer packages they receive, they can position related accessories or complementary products under the pickup counter ready to offer a helpful suggestion when the customer does collect the main item.

Summary

Retailers with online stores are now building much bigger databases than they had before online retailing emerged. Couple this development with technical approaches that allow customer data to be aggregated across channels provides significant opportunities to grow sales and profits. We have given a number of real-world examples of how to exploit these possibilities above.

The key steps to be able to do this include:

- The data necessary to support these innovations can and needs to be captured. It must be done at the right levels of granularity and it must have the underlying data warehouse technology to hold it all and support the many kinds of analysis to evaluate and exploit the possibilities.

- The core systems of the business must capture this data and feed the data warehouse.

- A variety of analytics tools are needed to provide analysis and modelling capabilities.

- AI is becoming more widely adopted and its value to retailers will grow substantially over the next 10 years as more and more applications become available to exploit these possibilities.

- Retailers will need their own analytics teams or very good support from industry third parties like HSO in order to invest wisely and achieve the benefits that can be realised.

Improving Import Performance and Containing Cost Increases

Most retailers import goods from overseas for a percentage of their product range. For years now, this has generally been a high percentage and much of it has come from the Far East. China has the biggest share, but as China has become more expensive, the shares taken by India, Pakistan, and Vietnam have grown. In this article, we will review some of these problems in more detail and provide recommendations on how to address and, at least, reduce some of these challenges.

Empower your staff with Power Virtual Agents

Power Virtual Agents helps you to support your staff by creating AI-powered chatbots for a wide range of requests — from providing, for example, current stock availability to getting access to the analytics dashboard, where your employees spend the most amount of time answering questions.