Facts and figures

Improving Import Performance and Containing Cost Increases

Most retailers import goods from overseas for a percentage of their product range. For years now, this has generally been a high percentage and much of it has come from the Far East. China has the biggest share, but as China has become more expensive, the shares taken by India, Pakistan, and Vietnam have grown.

More recently, there has been growth in the imported volumes from Eastern Europe and Africa. One driver for this has been the shorter distances and hence lead times involved. Most recently, the Covid Pandemic has significantly disrupted supply chains, causing a greater level of stocks in stores, higher safety stocks, deteriorating customer service standards and steep rises in costs. The war in Ukraine has added to this.

In this article, we will review some of these problems in more detail and provide recommendations on how to address and, at least, reduce some of these challenges.

90%

of the world’s containers are manufactured in China. During the Pandemic, this situation led to significant shortages in shipping containers worldwide.

1000

ships were estimated to be queueing at the port of Shanghai in April 2022.

6 weeks

delay to unload ships at destination ports can happen due to port congestions.

80%

If the load of the container ship is 80% of capacity or more, the container might be shipped as full, and the wasted space increases the unit cost of the goods.

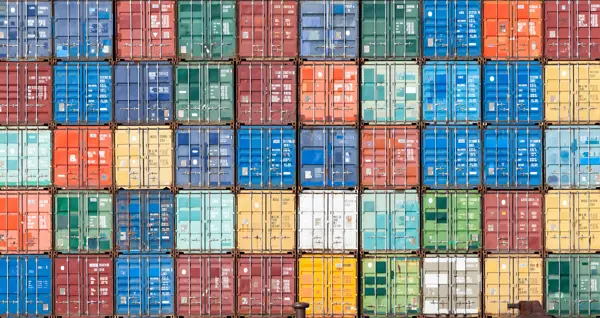

Container Management

The availability of shipping containers has been a major problem in recent years. This occurred for several reasons:

- The reduced container production in China due to Covid. 90% of the world’s containers are manufactured there.

- More existing containers are being used for Chinese internal needs as Chinese consumers became more prosperous.

- Delays unloading ships at destination ports due to port congestion and Covid knock-on effects. At times, ships were waiting at destination ports for up to 6 weeks just to unload.

- Goods manufactured in Asia could often not be shipped on time, as so many containers were parked outside ports waiting to be unloaded and returned to country of origin.

As a result of these factors, costs of hiring containers soared, causing importers significant cost increases and lack of visibility of where goods are.

Containers can be shipped FCL or LCL:

- FCL means the container has a full load from one factory or from one retailer consolidating freight in or near the country of origin.

- LCL is when a retailer wants to ship less than a container load.

If the load is 80% of capacity or more, the container might be shipped as full, and the wasted space increases the unit cost of the goods. Or shipping companies and freight forwarders could consolidate orders from different companies to create full containers. This form of consolidation became more important on nearly full containers as costs rose.

Shipping Delays and Port Bottlenecks

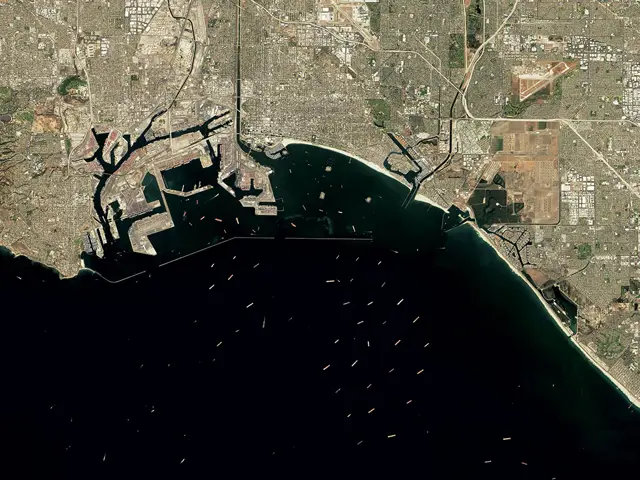

The image on the left shows ships waiting to unload outside the port of Long Beach in California, courtesy of NASA in October 2021.

This is one example. The situation was similar at Felixstowe, which handles 36% of UK container receipts and was common across most ports in the West.

It has now eased a lot but is still a challenge. Many container ships can carry 10,000 or more containers and it can take up to 3 business days to unload one ship, so the number of containers temporarily unavailable because of queues is very large.

The implementation of Brexit added to the problems, but it only affects shipments from the EU or shipments that were diverted to the EU because of backlogs at UK ports. The two key issues with Brexit were:

- Having all the right paperwork (or electronic equivalent)

- Using the right commodity codes.

For those companies using Import Agents, these issues have largely been dealt with now, but smaller companies choosing to handle this task themselves still report problems.

Imagine running supply chains, when:

- You can’t accurately predict whether there will be enough containers available when your goods are ready at the factory.

- You don’t know when the ship you booked will sail.

- It will be unloaded at the destination port, and

- You aren’t sure that all the customs documentation will be in order to clear the goods and release them for collection by the retailer or their agent.

Once a container or trailer clears Customs at the port, the retailer or their agent has a limited time to remove it from the port parking area. Normally, the contract with the Shipping company specifies a small number of days of free storage at the port, say 2 or 3. If the container has not been removed by then, a daily charge known as demurrage will be levied. This is initially quite modest, often between £50 and £100 per day. However, after a few days the daily rate increases rapidly. Driver shortages sometimes give problems achieving this.

A newsletter called Shipping Watch reported 376 container ships queueing at ports

around the world in September 2021 with 2.4 million containers on board, approximately 13% of the world’s supply. In April 2022, 1,000 ships (of all types) were estimated to be queueing at the port of Shanghai. - Shipping Watch Newsletter

Supply chain risk assessment demo

The Supply Risk Assessment Workspace in Microsoft Dynamics 365 is a helpful tool for managing risk. It provides a user-friendly dashboard that allows you to easily view your orders by various key insights and groups, helping you effectively manage supply chain risks.

Addressing These Challenges

Firstly, review your container packing processes and see whether you can improve container fill and hence reduce the number you need to ship, by using the techniques the larger retailers use. For example, having the supplier pack items like pillows and duvets in vacuum sealed bags after extracting the air, shipping footballs before pumping them up, wheelbarrows, Woks and products that can be nested if not fully assembled should be shipped only part assembled.

The last stages of assembly can be carried out in the UK by relatively untrained labour. You can assess the cost of the UK final assembly against the container costs, to see where it makes sense to do that.

The important ways to address these challenges boil down to real time or near real time visibility of what’s going on in the supply chain and data analytics.

1. Visibility

As far as possible have a common supply chain portal to which all parties involved can be connected or integrated.

Typical of the processes the portal should support include:

- Post purchase orders on the portal for manufacturers to download and process on their internal systems.

- Mandate suppliers to post manufacturing progress against the delivery schedule including key stages like:

- Availability of all raw materials.

- When production capacity is scheduled.

- How much of the order is now in work in progress inventory.

- How much is finished goods stock.

- How much is packed ready for shipping.

- How much has been delivered to the port of despatch.

- Suppliers can invoice through the portal and provide credit notes, where applicable.

- This should also include details on any aspect of the order that cannot be fulfilled as requested, for example, due to raw material shortages or defects, labour disputes, etc.

With this level of visibility such a portal provides, for example, you can decide whether you should expedite receipt of an initial injection or replenishment inventory by using air freight, which is more expensive but can overcome delays. It may be cheaper than the cost of clearance markdowns if the goods go on sale too late to achieve their potential.

2. Data Analytics

Given that you now have the best visibility you can manage, having the right dashboards, reporting and analytical abilities is the next key component.

Some examples of what you might need in this case include:

- Real time alerts when anything deviates from the expected, for example, the purchase order cannot be fulfilled as written, the ship will not sail on time, etc.

- Analysis of the performance of all the parties involved concerning the successful fulfilment of their obligations or the lack of. For example:

- Reporting key metrics for each of your suppliers in terms of accuracy of order fill, quality of product received and conformance to sealed samples, number of samples needed to get to an approved sample, timeliness of all activities, accuracy of invoicing.

- Reporting on the performance of your Import Agent on the fulfilment of their obligations and their adeptness at solving problems associated with delays.

- Reporting on the issues arising (nature and frequency) with Customs paperwork and Customs clearance.

- Reporting on shipping company performance.

Performance data should be made available to all interested parties for several main purposes:

- Buyers and internal Imports Section staff can monitor progress against plans and now when they need to intervene to address issues of concern.

- Vendor management teams get greater insight into vendor performance.

- All involved parties can use the historical insights to plan more intelligently for future operations knowing, for example, where future plans need more contingency built in.

Create an infrastructure

- 1

Tracks process

execution in real time or near real time.

- 2

Issues alerts

to quickly highlight when activities don’t happen or are late.

- 3

Provides performance reporting and predictive analytics

so that adjustments can be made much closer to a problem being identified.

- 4

Generates the aggregated performance data

to make critical decisions like changing suppliers for future orders, or sourcing near shore rather than far shore, say, thereby improving resilience.

Continue reading

Get more insights from HSO Retail Experts