The reporting obligation of the CSRD has different dependency factors

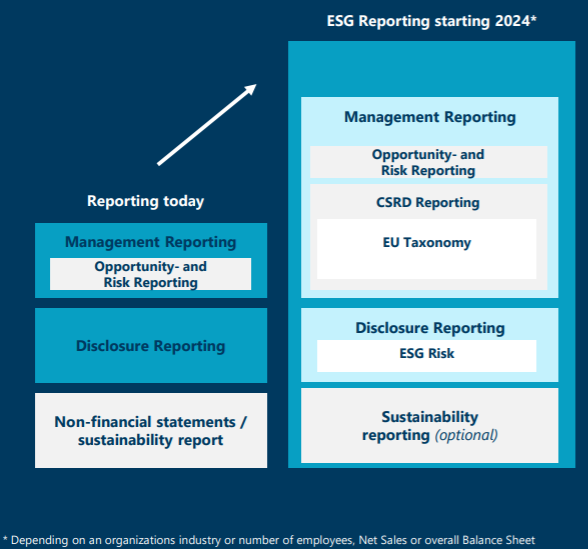

Sustainability as a changing factor in external reporting

What is CSRD?

The CSRD is a proposed new directive that will replace the NFRD (Non-Financial Reporting Directive) and extend the scope of sustainability reporting requirements. The CSRD is a legal obligation adopted by the EU as a result of the Green Deal. Its goal is to make all companies climate-neutral by 2050, and it requires all companies to actively contribute to achieving this EU target.

Implications of CSRD

ESG strategy

- Comprehensive reporting on strategies and policies across all dimensions of sustainability

- Requirements for displaying ESG metrics

Report contents

- Expansion of reporting according to standardized specifications

- New stakeholders in the reporting process by expanding the scope of the report

Processes & Governance

- Expansion of the scope

- Introduction of external audit requirements, as reporting becomes part of the group management report

Data & Platform

- New quantitative reporting requirements and KPIs across all pillars of E, S and G

- Establishment of an audit-proof and partly group-wide data supply

Tagging of report contents

2024

All listed companies or financial companies that offer financial products or

< 500 employees or one of the other criteria,

< 40 million EUR sales revenue

< 20 million EUR balance sheet total2025

> 250 employees or one of the other criteria,

> EUR 40 million in sales revenues

> EUR 20 million in total assets2026

10 employees or two other criteria

> 700 thousand EUR sales revenue

> 350 thousand EUR balance sheet total2028

Non-EU companies that have at least one subsidiary or branch within the EU or a group turnover of EUR 150 million

What happens if I leave ESG reporting until 2025?

Delaying ESG reporting until 2025 could result in various missed opportunities to showcase your commitment to sustainability before more stringent regulations come into place. Several regulations are almost certainly due to be implemented before 2025.

In terms of non-legal impacts, this delay could harm your reputation and lead to the loss of current and potential customers. Regarding legal impacts, as implementing ESG reporting solutions can be a time-intensive endeavour, waiting until 2025 to comply could cause you to fall behind. The longer you wait, the harder it will be to catch up with regulatory requirements. The risk of not complying with increasingly strict regulations on time could significantly impact your company and attract legal consequences.

What are the Current and Future UK regulations?

As of now, the UK lacks a regulatory framework that mirrors the strictness of the EU CSRD. However, the UK has already implemented existing ESG regulations, such as the SECR and BEIS. Moreover, there is a likelihood of the emergence of future regulations that could share similarities with the CSRD such as the SDS and UK SDR.

Lunch & Learn HSO Environmental Social & Governance (ESG) Reporting Framework

Watch our on-demand webinar in which we discussed about The ‘HSO ESG Reporting Framework’ helps companies tackle the 2024 increases in regulatory reporting requirements driven by many investment organisations and governmental bodies such as the EU Corporate Sustainability Reporting Directive (CSRD).